There is no denial in the fact that Dogecoin is

one of those rare coins that had the most terrible phase of its crypto

journey in the month of August. The coin clearly closed the last month

with a bearish trend and enormous losses. Although the starting quarters

brought a substantial change in its price but, quite unfortunately, the

third quarter destroyed all the chances of recovery.

In

fact, the worst part that one needs to acknowledge is the fact that the

Dogecoin has indeed reached the point from where it started.

However,

not everything has been lost yet as the analysts still believe in the

fact that the upcoming month is going to witness some really remarkable

escalation in the price of the Dogecoin.

THE PRESENT STATE OF DOGECOIN

Before analyzing the coin into its depth, let’s have a look at where it stands now.

Considering the current statistics of the crypto, the coin has now got an ROI of 343.73% and has been trading at $0.00250289.

As far as the 24-hour volume is concerned, it can be found somewhere around $23,058,645.

Speaking

about the market cap of the firm, it has been around $300,036,054

whereas the circulating supply is found to be 121,009,493,835 DOGE.

LET’S LOOK AT THE PRICE COMPARISION

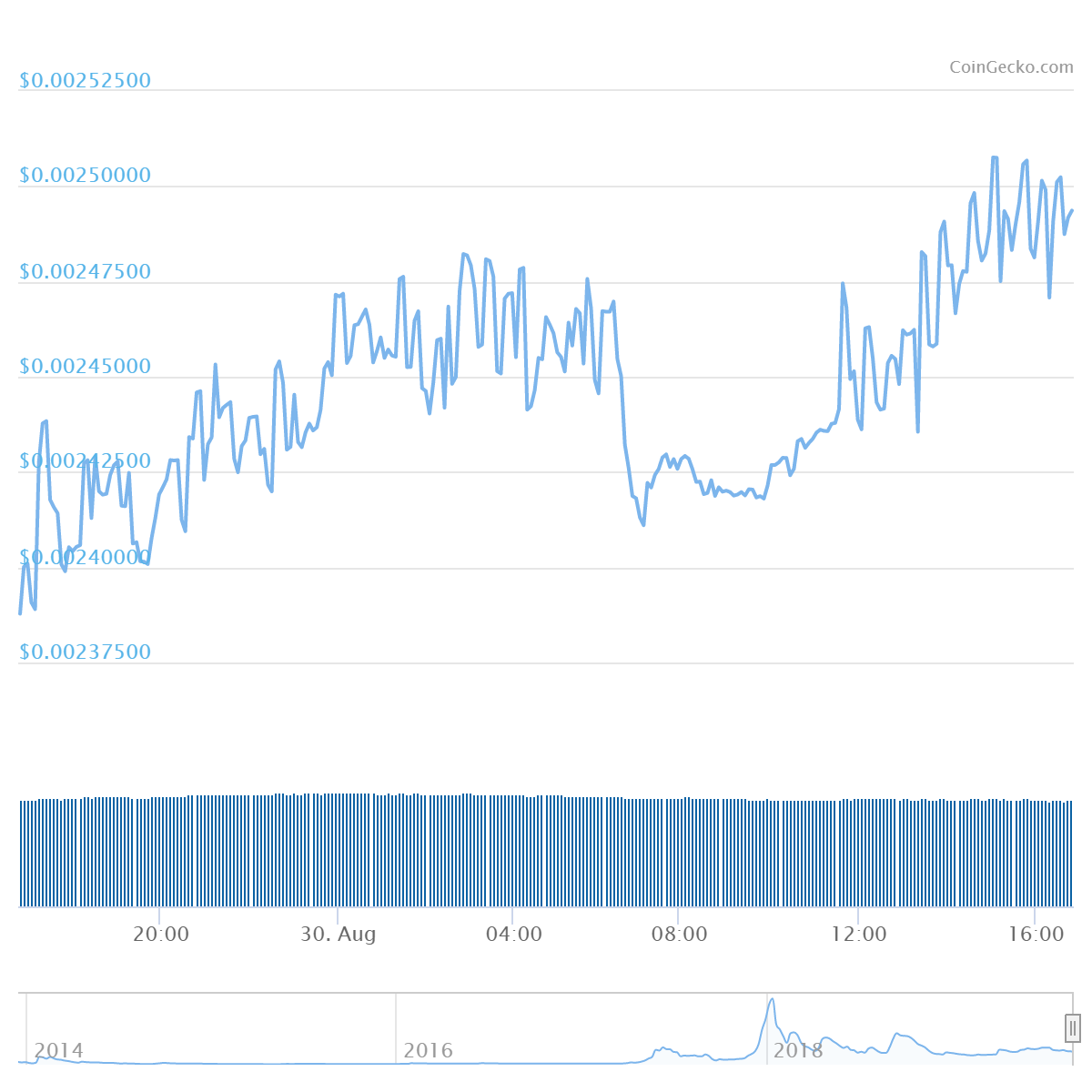

The

31st of August witnessed an opening of the DOGECOIN market at $0.00249.

Quite fortunately, there was a straight upliftment in the price that

resulted in the rise of up to 4.72%. This changed the price of the coin

from $0.0024 to $0.0025.

However,

the bulls were perhaps not in favor of DOGE. This is so because, by the

end of the first half of the day, the coin lost almost more than the

escalation. It went down by 4.97%, thus shifting the price of the coin

from $0.00249 to directly $0.00237.

Soon

enough the coin was able to recover from the recent pullback. In fact,

it made a better comeback by jumping from $0.00239 to straight $0.00250.

Thus, it depicted a growth of 4.84%. And finally, the coin closed at

$0.00249, thus not much profit in hand.

As of 1st September, the coin kept hovering around $0.00250.

SHOULD YOU INVEST?

Although, it has always been believed that DOGECOIN has been in the footsteps of Bitcoin, but this fact is not much convincing for the present scenario.

After the disappointing journey in the month of August, Dogecoin seems to have lost the majority of the faith from the market.

Intraday trading is not at all recommendable at this point.

However, since the coin is hitting its low, the long-term investment might be a better plan.